Different Types of Long-Term Care Insurance (LTCI) Policies

You'll need to choose the sort of protection item you need to buy. Contingent upon the kind of strategy you select, there might be an altogether extraordinary sort of medical advantage structure. This is a key factor that decides the multifaceted nature.

|

| Different Types of Long-Term Care Insurance (LTCI) Policies |

- Individual and Group Coverage: This is a typical decision for many individuals. They pick an unattached LTCI arrangement that accompanies just long-haul mind benefits. Anybody can apply for an individual business LTCI approach.

In any case, it's great to realize that numerous individuals are likewise qualified for a gathering item that is supported by a private or open manager, a religious association or an affiliation. Gathering arrangements are generally more affordable. The restorative guaranteeing is less stringent also.

There are organizations offering association strategies in these four expresses that likewise offer individual business items that rival their own association offerings. Congress has additionally passed the Deficit Reduction Act that has extended the association choice to every single intrigued state. Numerous new association programs are being received in alternate states too.

Shoppers can choose from six diverse LTCI programs. Everything relies upon the individual's own particular or a life partner's qualification for at least one gathering projects or items. Decisions may incorporate (1) the government LTCI program for present or previous elected laborers, (2) a state open worker program, (3) a private business supported LTCI program, (4) an affiliation or confidence supported gathering scope, (5) an individual, industrially sold LTCI item, or (6) an association approach.

These items are unique in relation to every other. Numerous individuals are not sufficiently educated and they can't subsequently choose, in this manner adding to the perplexity.

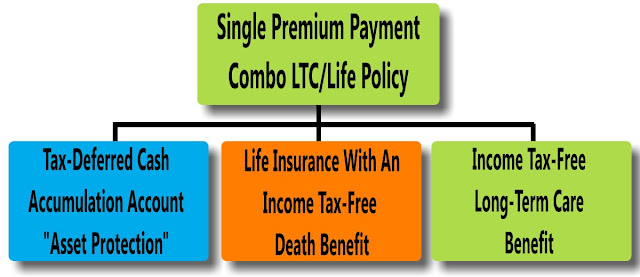

Mix PRODUCTS

Customers can choose an approach which offers LTC benefits together with an extra security or annuity arrangement.

- A disaster protection strategy quickens installment of the demise advantage. It gives finances that can be utilized to pay for the mind as said in the arrangement. The living arrangement may likewise incorporate a rider for LTCI benefits. This is the remain solitary LTCI approaches. The advantages of an LTCI rider are regularly paid after the quickened installment for the passing advantage is depleted.

- An annuity can likewise incorporate a rider for LTCI. The LTCI rider benefits are paid after the trade an incentive out the annuity is depleted.

There is a long holding up period before the advantages of the LTCI rider is activated in both the annuity and quickened disaster protection passing advantage. In some of these items, you'll need to pay a solitary lifetime premium in advance, and in others, you're requested to pay the premium over a pre-chosen number of years. No premiums are expected after this.

A few people, especially youngsters frequently stress over paying premiums for a more drawn out time, and that too for benefits they may never need to utilize. They regularly jump at the chance to consolidate in light of the fact that it sounds good to them.

Arrangement COVERAGE

LTCI arrangements will ordinarily offer advantages for a various mix of helped living, group and home care, and nursing home care. Customers have the alternative of restricting advantages to a few sorts of care or they may go for a thorough arrangement of advantages. Items are generally advertised in three diverse ways:

- Comprehensive approaches give advantages to administrations at all levels of home, group-based and institutional care.

- Facility-just strategies pay only for mind inside the institutional setting, for example, a nursing home. In any case, there are strategies that likewise incorporate nurture helped living. It relies upon how the care is characterized in the arrangement.

- Policies only for home-mind give benefits just for home care, and on a few occasions group based care (like grown-up day mind) too. It relies upon the state prerequisites where these arrangements are sold.

A great many people who purchase office just approaches are typically stressed over the high cost of nursing home care. They trust that it may be hard to bear the cost of a far-reaching scope design.

No comments:

Post a Comment